Customised vs Commoditised: Optimise your FX liquidity

In this article we explore best practices on liquidity management and how IS Prime and the ISAM capital markets group interact with liquidity providers.

Liquidity is one of the key requirements for successful trading across all asset classes and naturally, is a prequisite for starting and managing a broker. FX is no exception, with liquid markets bringing smoother transaction flows and more competitive pricing. In the past, when the going was good and it was easier to turn a profit, retail brokers had less need to optimise their liquidity.

Now however, it’s a much tougher marketplace as a result of regulatory changes, the pressure to keep up with technological developments and the effects of market volatility. The retail market is also a much more educated and demanding client base and expects better trading conditions and environments.

Tier 1 liquidity providers

Many retail FX brokers opt to use multiple liquidity providers, but this can become unwieldy and lead to errors because it fragments resources and capital requirements, as well as significant increase in both explicit and implicit costs. There are also knock-on technological and trading issues - the greater the number of liquidity providers and platforms, the greater the likelihood of an inaccurate or latent quote.

Although adding liquidity providers can improve spreads in the short term, it eventually impacts execution and results in poor fills, delays, and rejections. As we have covered before, this leads to price deterioration over time, thereby requiring the addition of yet more liquidity providers to reverse the decline in spreads. This leads to worse execution and the need for more LPs, and so on… it is a vicious circle.

With IS Prime and the ISAM capital markets group, optimisation is achieved by concentrating on quality rather than quantity. Liquidity is aggregated primarily from Tier 1 liquidity providers – a small and select group that ensures a high-quality focus with whom we work closely to ensure that our clients have the best possible setup and execution experience for their flow. When assessing liquidity providers, we look for key performance indicators such as spread, response time, fill ratios, latency of pricing, market impact and cost of rejections.

Customised FX liquidity

Customisation is another important way to optimise liquidity. We build and protect liquidity by carefully routing customer’s flow, ensuring clients execute using the best possible liquidity for their trading styles - this creates tight and consistent pricing. When we create an FX liquidity pool, we analyse a client’s trading in real time and adjust the pool to ensure they are getting an optimal experience - this can include the addition or removal of specific providers, as well as the automated routing of aggressive flow, identified by our proprietary systems, to specific aggregations. This is done in order to ensure that core spreads are not affected and that they are maintained in the long term.

In order to do this, having the right technology is crucial. Optimising liquidity requires systems that afford clear oversight and control of diverse flows, and provide intelligent routing and close monitoring of liquidity providers. The group uses flow analytics and smart order routing engines to ensure that flow goes to the appropriate liquidity provider for the best trading experience. In addition, we have quant teams who are in regular contact with their counterparts at the major bank and non-bank liquidity providers. Together we determine all elements of the flow directed to these institutions, which further helps to achieve the best pricing.

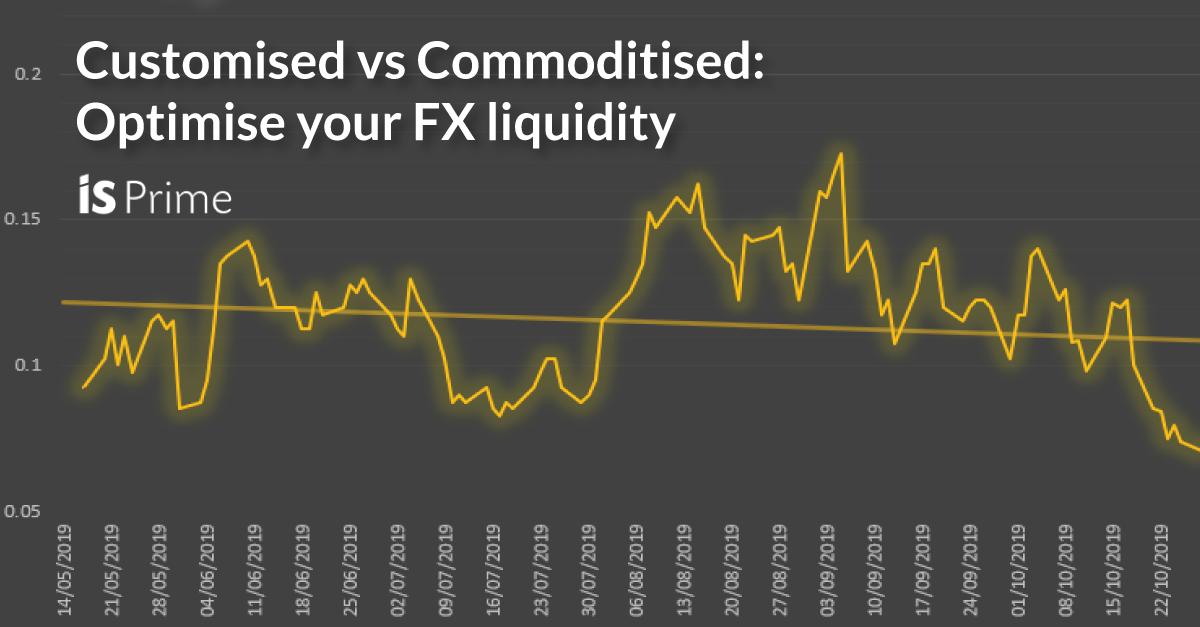

The benefits of this can be easily and quantifiably demonstrated when comparing IS Prime’s spreads vs one of its major competitors, as shown below. The chart is displaying IS Prime's EURUSD average spread in yellow from 14/5/19 to 15/11/19 compared to data sourced from a competitors website.

[Source: IS Prime Tick Database moving average vs data sourced from competitors website]

Protecting our liquidity providers from predatory flow ensures that we maintain our pricing and execution quality over the long term whereas, as shown, venues that are unable to do this will continue to see their providers widening pricing over as time as LPs protect themselves from the lowest common denominator - the most aggressive client.

Liquidity insights and actions

Reviewing your liquidity arrangements is an important first step for optimisation, which is where IS Prime can place you on the right path with a liquidity audit. As part of our consultancy services, we provide detailed ‘health checks’ to promote optimisation across all aspects of a client’s business. Many organisations have convoluted and inefficient liquidity structures, and this health check can help to identify the weaknesses and highlight steps for improvement.